Equity Analyst

Equity Analyst: A Comprehensive Career Guide

An equity analyst is a financial professional who specializes in researching and analyzing stocks (equities) of publicly traded companies. Their primary role is to provide insights and recommendations to help investors, portfolio managers, or clients make informed decisions about buying, selling, or holding specific stocks. They delve deep into company financials, industry trends, management quality, and competitive positioning to determine a stock's potential value.

Working as an equity analyst can be intellectually stimulating. You'll constantly be learning about new companies and diverse industries, piecing together complex information like a detective. The role often involves direct interaction with company executives and institutional investors, placing you at the heart of financial market activity. Furthermore, the potential to influence significant investment decisions provides a tangible sense of impact.

What Does an Equity Analyst Do?

Equity analysts are the researchers of the stock market. They gather and interpret vast amounts of data about specific companies and the industries they operate in. This involves meticulous study of financial statements, economic reports, and market news to understand a company's health and future prospects. The goal is to identify investment opportunities or risks.

These professionals work for various financial institutions. On the "buy-side," analysts work for firms like mutual funds, hedge funds, or pension funds, providing research internally to portfolio managers who make investment decisions for the firm's or clients' capital. On the "sell-side," analysts typically work for investment banks or brokerage firms, producing research reports and recommendations for clients of the firm, aiming to facilitate trading activity.

Analyzing Companies and Industries

A core task is dissecting a company's financial health. Analysts scrutinize income statements, balance sheets, and cash flow statements to assess profitability, debt levels, and operational efficiency. They compare these metrics against historical performance and industry peers to gauge relative strength.

Beyond the numbers, understanding the industry landscape is crucial. Analysts investigate competitive dynamics, regulatory changes, technological shifts, and macroeconomic factors affecting the sector. This broader context helps them understand the forces shaping a company's future success or failure.

Mastering financial statement analysis is fundamental. These courses provide the necessary grounding in interpreting financial reports and understanding key ratios.

For a foundational understanding, these books offer comprehensive insights into reading and analyzing financial statements.

Developing Financial Models and Valuations

Analysts build complex financial models, often using software like Excel, to forecast a company's future earnings, revenue, and cash flows. These models incorporate assumptions based on their research about the company's strategy, market position, and economic outlook.

The ultimate goal of modeling is often valuation – determining what a company's stock is truly worth. Analysts use various techniques, such as Discounted Cash Flow (DCF) analysis, comparable company analysis (comps), and precedent transactions, to arrive at an intrinsic value estimate for the stock.

This valuation is then compared to the current market price to form an investment recommendation: buy (if undervalued), sell (if overvalued), or hold (if fairly valued). Developing robust financial models requires both technical skill and sound judgment.

Developing strong modeling skills is essential. These courses cover Excel-based financial modeling techniques used in valuation and analysis.

Communicating Recommendations

Analysis is only valuable if it can be clearly communicated. Equity analysts spend significant time writing research reports that detail their findings, assumptions, valuation, and investment thesis. These reports need to be persuasive, well-supported, and easy for portfolio managers or clients to understand.

Beyond written reports, analysts frequently present their findings verbally. This could involve internal meetings with portfolio managers, calls with institutional clients, or even media appearances for senior analysts who are recognized experts in their sector.

Strong communication skills, both written and verbal, are therefore essential for translating complex financial analysis into actionable investment ideas. Analysts must be able to defend their reasoning and respond effectively to questions and challenges.

Monitoring Performance and Markets

The job doesn't end once a recommendation is made. Equity analysts continuously monitor the companies they cover ("under coverage") and the broader market. This involves tracking company news releases, earnings announcements, industry developments, and economic data.

They update their financial models and investment theses as new information becomes available. Market conditions can change rapidly, requiring analysts to be vigilant and adaptable in reassessing their views.

Monitoring also involves tracking the performance of their recommendations. Understanding why a stock performed as expected, or why it deviated, helps refine their analytical process and improve future forecasts.

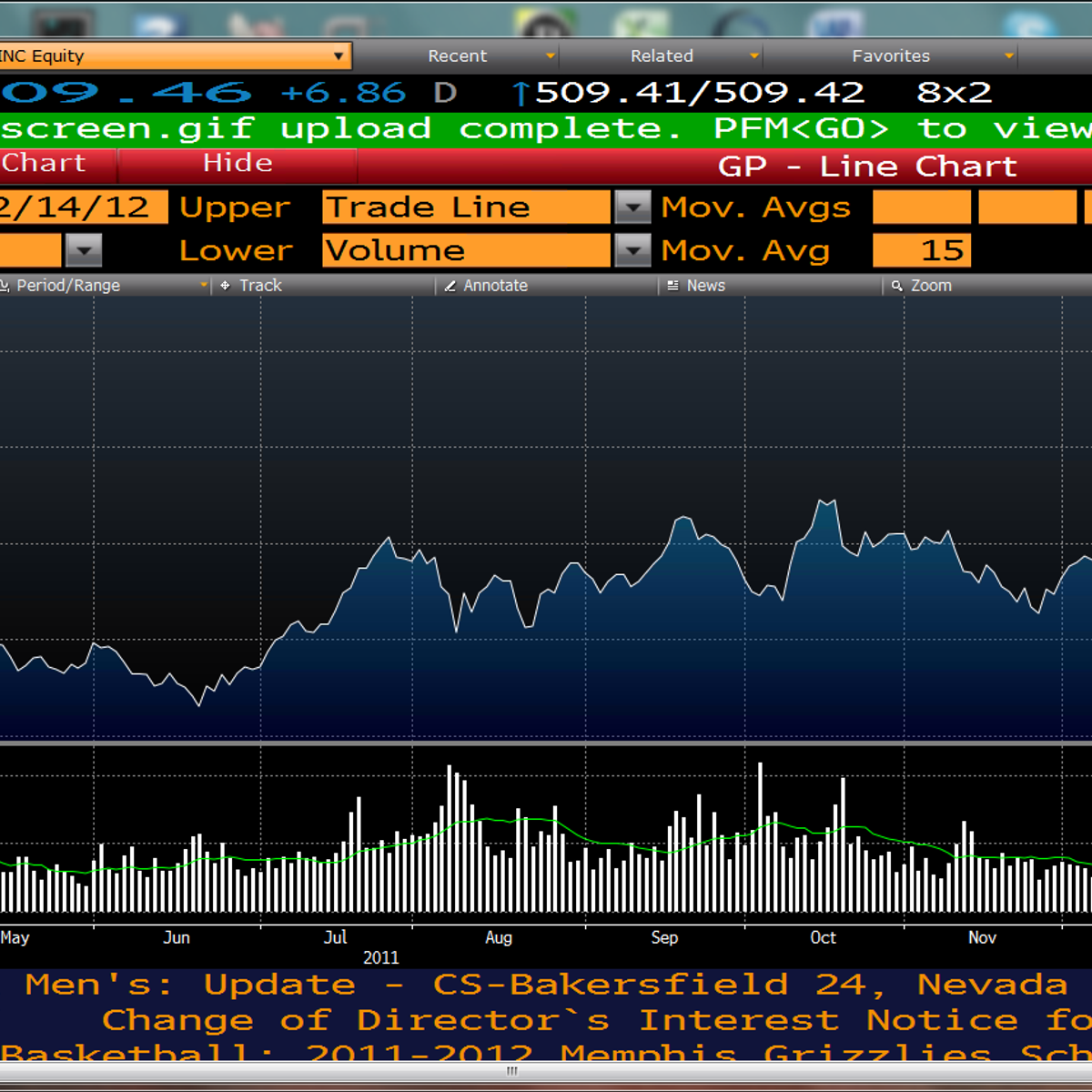

This course provides insights into analyzing market data using industry-standard tools.

The Equity Analyst Career Path

The journey to becoming a senior equity analyst typically follows a structured path, starting with foundational roles and progressing through increased responsibility and expertise. It's a demanding career but offers significant opportunities for growth and specialization within the finance industry.

While the core skills revolve around analysis and valuation, success also hinges on building industry knowledge, developing strong communication skills, and cultivating relationships within the financial community.

From Research Associate to Analyst

Most individuals enter the field as Research Associates after completing a bachelor's degree, often in fields like finance, economics, accounting, or quantitative disciplines like math or statistics. Associates work under the guidance of a senior analyst, supporting them by gathering data, building initial financial models, and contributing to research reports.

This period, typically lasting two to five years, is crucial for learning the ropes, mastering analytical techniques, and gaining exposure to specific industries or sectors. High-performing associates demonstrate strong analytical capabilities, attention to detail, and a proactive approach to research.

Promotion to an Equity Analyst role signifies readiness to take ownership of covering a specific group of stocks (a "coverage universe"). Analysts develop their own investment theses, publish research under their name, and interact more directly with clients or portfolio managers.

Entry-level roles often require strong foundational knowledge in finance and valuation, which can be built through dedicated study.

Advancement and Alternative Paths

Experienced equity analysts can progress to senior analyst roles, potentially leading a research team covering a specific sector. Senior analysts often have greater autonomy, deeper industry expertise, and more significant client interaction or influence on portfolio decisions. Some may achieve titles like Vice President (VP), Director, or Managing Director (MD) within their firms.

The skills developed as an equity analyst are highly transferable. Many analysts transition to the buy-side, becoming portfolio managers responsible for making the final investment decisions based on research from analysts. Portfolio management often requires a broader understanding of asset allocation and risk management.

Other potential career pivots include roles in corporate finance or corporate development within companies (often in the sector they previously covered), investor relations, investment banking, or financial consulting. The analytical rigor and industry knowledge gained are valuable across many finance-related fields.

This book offers insights into managing investment portfolios, a common next step for analysts.

Understanding Buy-Side vs. Sell-Side

It's important to understand the distinction between buy-side and sell-side roles. Sell-side analysts work for brokerages or investment banks. Their research is primarily used to advise clients (institutional investors, high-net-worth individuals) on stock decisions and generate trading commissions or advisory fees for their firm. They often publish detailed reports with buy/sell/hold ratings.

Buy-side analysts work for institutions that manage money directly, such as mutual funds, pension funds, hedge funds, or asset management firms. Their research is proprietary and used internally to make investment decisions for the firm's portfolios. The focus is on generating returns for the fund's investors.

While the core analytical skills overlap, the day-to-day focus and incentives can differ. Sell-side roles often involve more report writing and client interaction, while buy-side roles may focus more intensely on generating unique investment ideas for internal use. Career progression can involve moving from the sell-side to the buy-side, which is often seen as a desirable step.

Building Your Foundation: Education and Credentials

A strong educational background is typically the first step toward a career as an equity analyst. While specific requirements vary, certain academic paths provide the necessary quantitative and financial grounding. Beyond formal degrees, professional certifications play a significant role in career advancement.

Employers look for candidates who possess not only theoretical knowledge but also the practical analytical skills needed to dissect complex financial information and make sound judgments.

Relevant Degrees and Coursework

A bachelor's degree is the standard entry requirement. Majors in finance, economics, accounting, or business administration are common choices as they provide direct exposure to financial principles, markets, and analytical methods. Degrees with a strong quantitative focus, such as mathematics, statistics, physics, or engineering, are also highly valued for their emphasis on analytical rigor and problem-solving.

Regardless of the major, coursework in accounting, corporate finance, statistics, econometrics, and investment principles is essential. Developing proficiency in spreadsheet software like Microsoft Excel is also critical, as it's a primary tool for financial modeling.

These courses cover fundamental concepts in corporate finance and investment analysis.

For those seeking a strong foundation, these comprehensive texts cover core finance and investment principles.

The Role of Advanced Degrees and Certifications

While not always mandatory for entry-level positions, advanced degrees like a Master of Business Administration (MBA) with a finance concentration or a Master's in Finance can accelerate career progression, particularly towards senior analyst or portfolio management roles. These programs deepen financial expertise and often provide valuable networking opportunities.

The most highly regarded professional credential in the investment industry is the Chartered Financial Analyst (CFA) designation, awarded by the CFA Institute. Earning the CFA charter requires passing three rigorous exams covering ethics, quantitative methods, economics, financial reporting, corporate finance, equity investments, fixed income, derivatives, alternative investments, and portfolio management. It signals a strong commitment to the profession and a high level of expertise.

While not strictly required to start as an associate, the CFA charter is often preferred or even required for advancement to senior analyst positions and is considered the gold standard for investment professionals globally. Many firms support their analysts in pursuing the CFA designation.

These resources provide insights aligned with the rigorous curriculum of professional certifications like the CFA.

Skill Development Through Online Learning

Formal education provides a strong base, but continuous learning is vital in the dynamic field of finance. Online learning platforms offer flexible and accessible ways to acquire specific skills, supplement traditional education, or facilitate a career pivot into equity analysis.

Whether you're a student wanting to bolster your resume, a professional seeking to upskill, or someone exploring a career change, online courses provide targeted training in key areas like financial modeling, valuation, and industry analysis.

Platforms like OpenCourser aggregate thousands of courses, making it easier to find resources tailored to your specific learning goals. You can search for courses on Finance & Economics or dive into specific techniques.

Building Essential Skills Independently

Online courses excel at teaching practical, job-relevant skills. You can find numerous courses focused specifically on building financial models in Excel, covering everything from basic three-statement models to complex Discounted Cash Flow (DCF) valuations and sensitivity analysis. These courses often use real-world case studies, allowing you to apply concepts immediately.

Beyond modeling, you can find courses on specific valuation techniques, financial statement analysis, industry research methods, and even introductions to using financial data terminals like Bloomberg (though access to terminals themselves usually requires an institutional subscription).

The self-paced nature of online learning allows you to focus on areas where you need the most development, fitting study around your existing commitments. Many courses offer certificates upon completion, which can be added to your professional profile.

These courses are designed to build practical financial modeling and analysis skills valuable for aspiring analysts.

Portfolio Projects and Practical Application

Theoretical knowledge is important, but demonstrating practical application is key. Many online courses incorporate projects where you analyze real company data, build valuation models, or write mock research reports. Completing these projects provides tangible evidence of your skills.

You can also undertake independent projects using publicly available financial data from sources like company investor relations websites or financial data aggregators. Researching a company, building a valuation model, and writing a concise investment thesis can be a powerful addition to your portfolio when applying for jobs.

Sharing these projects (while respecting data usage policies) on platforms like LinkedIn or a personal website can showcase your initiative and analytical abilities to potential employers. OpenCourser's list management feature can also help you organize and share collections of courses or projects you've completed.

These courses focus on portfolio construction and management, offering ideas for practical application.

Balancing Self-Study and Certifications

Online courses are excellent for skill acquisition, but they don't fully replace the comprehensive knowledge base and credibility provided by formal degrees or certifications like the CFA. A balanced approach often works best.

Use online courses to build specific technical skills (like advanced Excel modeling) or explore specialized areas (like sustainable investing analysis) that might complement your formal education or CFA studies. They can help you prepare for interviews by ensuring your practical skills are sharp.

For those making a career transition without a traditional finance background, online courses combined with dedicated self-study for certifications like the CFA can create a viable pathway. However, be realistic – breaking into equity research is competitive, and demonstrating commitment through certifications is often crucial.

Consider exploring OpenCourser's Learner's Guide for tips on structuring your self-study and making the most of online resources.

Limitations and Setting Expectations

While online learning offers tremendous value, it's important to understand its limitations. Access to proprietary financial databases (like Bloomberg or FactSet) and direct mentorship from experienced analysts are typically found within academic programs or on the job.

Furthermore, the networking opportunities inherent in traditional degree programs or industry events are harder to replicate solely online. Breaking into the field often relies on networking alongside demonstrated skills.

Be prepared for a challenging journey, especially if you are pivoting careers. Equity analysis demands a high level of analytical rigor, long hours, and continuous learning. While online resources provide powerful tools, persistence, networking, and potentially pursuing formal credentials will significantly improve your chances of success.

Essential Tools and Technologies

Modern equity analysts rely on a suite of sophisticated tools and technologies to gather data, perform analysis, and communicate their findings. Proficiency with these tools is essential for efficiency and effectiveness in the role.

The technology landscape is constantly evolving, with new tools emerging, particularly in areas like data analysis and artificial intelligence. Staying current with relevant technologies is part of the job.

Financial Data Platforms

Access to real-time and historical financial data is paramount. Analysts heavily rely on specialized terminals and databases. The Bloomberg Terminal and Refinitiv Eikon (formerly Thomson Reuters) are industry standards, providing vast amounts of market data, news, company financials, analytical tools, and communication features.

FactSet and S&P Capital IQ are other widely used platforms offering comprehensive financial data, screening tools, and analytical capabilities. Familiarity with at least one of these platforms is often expected, and experience is a significant advantage.

While full access typically requires expensive institutional subscriptions, some universities provide access, and online tutorials can offer basic familiarity with their interfaces and functions.

This course specifically introduces using a key industry tool.

Spreadsheets and Programming

Microsoft Excel remains the workhorse for financial modeling and analysis. Analysts need advanced Excel skills, including proficiency with complex formulas, pivot tables, charting, macros, and data analysis tools, to build robust and flexible valuation models.

Increasingly, programming languages like Python are being adopted, particularly for handling large datasets, automating repetitive tasks, performing complex statistical analysis, and developing quantitative investment strategies. Libraries like Pandas, NumPy, and Matplotlib are commonly used for data manipulation, analysis, and visualization.

While deep programming expertise isn't always required for traditional fundamental analysts, basic coding skills and an understanding of how programming can enhance analysis are becoming valuable assets.

Mastering Excel for financial applications is crucial. This course provides in-depth training.

The Rise of AI and Automation

Artificial intelligence (AI) and machine learning (ML) are beginning to impact equity research. AI tools can help automate data collection from diverse sources, identify patterns in large datasets, analyze sentiment from news and social media, and even assist in generating initial drafts of research reports.

AI is not expected to replace human analysts entirely but rather augment their capabilities. Analysts who can effectively leverage AI tools to enhance their research process, identify unique insights, or improve efficiency will likely have an advantage. According to research from Clarity AI, AI-powered tools are enhancing portfolio analysis and streamlining reporting.

Understanding the potential and limitations of AI in finance, and potentially gaining skills in data science or machine learning, could be beneficial for future career prospects.

Compliance and Reporting Software

Equity research is a highly regulated field. Analysts must adhere to strict rules regarding information disclosure, conflicts of interest, and communication protocols (like Regulation Fair Disclosure or Reg FD in the US).

Firms use compliance software and internal systems to monitor communications, manage research dissemination, and ensure adherence to regulatory requirements. While analysts may not directly manage this software, understanding compliance obligations and using firm-approved communication channels is critical.

Industry Trends Impacting Equity Analysis

The world of equity analysis is not static. It evolves in response to market dynamics, technological advancements, regulatory changes, and shifting investor preferences. Staying aware of these trends is crucial for analysts to remain relevant and effective.

Current trends are reshaping how analysts conduct research, what factors they prioritize, and the very nature of the investment landscape they navigate.

ESG Integration

Environmental, Social, and Governance (ESG) factors have moved from a niche consideration to a mainstream component of investment analysis. Investors increasingly recognize that ESG issues can pose material risks or create opportunities for companies.

Analysts are now expected to integrate ESG analysis into their valuation models and research reports. This involves assessing factors like a company's carbon footprint, climate transition plans, labor practices, supply chain sustainability, data privacy policies, and board independence. Standardized frameworks like those from SASB or GRI are gaining traction, but assessing and quantifying ESG impact remains complex.

Expertise in ESG analysis is becoming a valuable specialization within equity research, as highlighted by MSCI ESG Research findings showing investor focus on these factors.

This course touches upon integrating broader factors into organizational strategy, relevant to the growing importance of ESG.

Quantitative vs. Fundamental Analysis

The debate between quantitative ("quant") analysis, which relies heavily on mathematical models and statistical techniques, and traditional fundamental analysis, which focuses on company specifics and qualitative judgments, continues. Many firms now employ a blend of both approaches.

The rise of big data and increased computing power has fueled the growth of quant strategies. Fundamental analysts benefit from incorporating quantitative tools for screening, data analysis, and risk management, while quant analysts often need domain expertise to build effective models.

Analysts who can bridge the gap between these approaches, understanding both the underlying business drivers and the statistical patterns, are increasingly valuable.

This book delves into quantitative methods highly relevant to modern investment analysis.

Impact of Algorithmic and High-Frequency Trading

The proliferation of algorithmic trading (using computer programs to execute trades based on predefined instructions) and high-frequency trading (HFT) has significantly increased market speed and complexity. This can shorten investment horizons and increase short-term volatility.

While fundamental analysts typically focus on long-term value, they must understand how algorithmic trading can affect stock prices in the short term and potentially create dislocations or opportunities. Market structure and trading dynamics are becoming more important considerations.

Emerging Markets and Global Focus

As global economies become more interconnected, understanding international markets is increasingly important. Many investment firms seek exposure to emerging markets for potential growth, requiring analysts with expertise in specific regions or countries.

Analyzing companies in emerging markets presents unique challenges, including differences in accounting standards, regulatory environments, political risks, and data availability. Analysts specializing in these areas need cultural understanding and adaptability alongside strong financial skills.

Ethical Considerations in Equity Research

Integrity and ethical conduct are cornerstones of the equity research profession. Analysts hold positions of trust, influencing significant investment decisions. Maintaining objectivity, managing conflicts of interest, and adhering to regulations are paramount.

The CFA Institute Code of Ethics and Standards of Professional Conduct provides a guiding framework for ethical behavior in the investment industry, emphasizing duties to clients, employers, the capital markets, and the profession.

Managing Conflicts of Interest

Conflicts of interest can arise in various situations. For example, sell-side analysts work for firms that may also have investment banking relationships with the companies they cover. There can be pressure, explicit or implicit, to issue favorable research to support these relationships.

Buy-side analysts might face pressure to align their recommendations with existing portfolio holdings or the views of senior portfolio managers. Analysts must prioritize objective analysis and disclose any potential conflicts that could compromise their independence and objectivity.

Regulation Fair Disclosure (Reg FD)

In the United States, Regulation Fair Disclosure (Reg FD) prohibits public companies from selectively disclosing material nonpublic information to analysts or institutional investors before disclosing it to the public. This aims to level the playing field for all investors.

Analysts must be diligent in relying only on publicly available information or information obtained through proper channels during company interactions. They cannot solicit or use material nonpublic information to gain an unfair advantage.

Responsible Use of Information

Analysts gather information from numerous sources, including company reports, management meetings, industry contacts, and expert networks. They must ethically source and use this information.

This includes respecting confidentiality, properly attributing sources where appropriate, and avoiding the use of illegally obtained or proprietary information. Building a mosaic of insights from legitimate sources is key, but crossing the line into using material nonpublic information is a serious violation.

Avoiding Biases in Forecasting

Financial forecasting is inherently uncertain, and analysts are susceptible to cognitive biases that can impair judgment. Confirmation bias (seeking data that supports existing views), anchoring bias (over-relying on initial information), and herding behavior (following the consensus) are common pitfalls.

Ethical analysts strive for objectivity by being aware of potential biases, rigorously challenging their own assumptions, seeking diverse perspectives, and focusing on a disciplined, evidence-based analytical process.

Understanding behavioral aspects can help analysts recognize and mitigate biases.

Challenges Facing Modern Equity Analysts

While offering rewarding opportunities, the career of an equity analyst is not without its challenges. The industry is evolving, bringing new pressures and requiring analysts to adapt continuously.

Understanding these challenges provides a realistic perspective for those considering this path and highlights the resilience and skills needed to succeed long-term.

Automation and AI

As discussed earlier, AI and automation are increasingly capable of performing routine data gathering and analysis tasks previously done by junior analysts. This puts pressure on analysts to move up the value chain, focusing on more complex analysis, critical thinking, industry expertise, and client relationships where human judgment remains crucial.

The ability to interpret data, synthesize complex information, understand nuance, and communicate effectively are skills less easily automated and likely to become even more important. Analysts need to embrace technology as a tool to enhance, not replace, their core skills.

Information Overload

The digital age has created an explosion of information. Analysts face the challenge of sifting through vast amounts of data, news, social media chatter, and research reports to identify what is truly relevant and material.

Developing efficient information filtering techniques, leveraging technology effectively, and maintaining focus on key value drivers are essential skills for navigating this deluge without getting lost in the noise.

Short-Term Performance Pressures

While fundamental analysis often focuses on long-term value, market participants, especially on the sell-side, can face significant pressure to generate short-term trading ideas or react quickly to quarterly earnings results.

This can sometimes conflict with a long-term investment perspective. Balancing the need to demonstrate near-term relevance with maintaining a disciplined, long-term analytical approach is a constant challenge.

Global Macroeconomic Uncertainties

Equity markets are increasingly influenced by global macroeconomic events, geopolitical shifts, and changes in monetary policy. Analysts must understand how these broader trends impact their specific sectors and companies.

Predicting macroeconomic shifts is notoriously difficult, adding another layer of complexity and uncertainty to company forecasting. Analysts need a strong grasp of economics and the ability to assess potential macro scenarios and their implications.

Frequently Asked Questions (FAQ)

Navigating the path to becoming an equity analyst involves many questions. Here are answers to some common queries from aspiring analysts and career explorers.

What's the difference between an Equity Analyst and a Portfolio Manager?

An Equity Analyst primarily focuses on researching specific stocks or sectors, performing deep analysis, building financial models, and making buy/sell/hold recommendations. A Portfolio Manager (PM) takes a broader view, using the research from analysts (and other sources) to construct and manage an entire investment portfolio according to specific objectives and risk constraints. The PM makes the final decisions on which securities to buy or sell and in what quantities, considering factors like asset allocation and diversification.

Is the CFA charter mandatory for entry-level roles?

No, the CFA charter is generally not mandatory for entry-level Research Associate positions. However, it is highly regarded and strongly recommended for career advancement. Many firms encourage or sponsor their associates to pursue the charter. Passing CFA exams demonstrates commitment and a strong grasp of investment principles, making candidates more competitive for analyst roles and promotions.

How volatile is job security in this field?

Job security can be influenced by market cycles and firm performance. During market downturns or periods of firm restructuring, layoffs can occur, particularly on the sell-side which is sensitive to trading volumes and deal flow. Buy-side roles may offer slightly more stability, but performance is key. Building strong expertise and a good track record enhances job security.

What are the typical work hours and travel requirements?

Equity analysis is known for demanding long hours, especially during earnings season or when working on major reports or deals. Working 60-80 hours per week is not uncommon, particularly in sell-side roles or at the start of one's career. Travel requirements vary; analysts may travel to meet company management, attend industry conferences, or visit clients, though the frequency depends on the specific role and firm.

What are career transition opportunities after being an equity analyst?

The skills are highly transferable. Common transitions include moving to portfolio management, hedge funds, private equity (though this often requires additional deal experience, perhaps via investment banking first), corporate finance/development roles at companies, investor relations, or financial consulting.

How might AI impact future job prospects for equity analysts?

AI is expected to automate more routine tasks like data gathering and basic analysis, potentially reducing demand for purely data-processing roles. However, AI is also seen as a tool that can augment analyst capabilities. Analysts who can leverage AI, focus on higher-level critical thinking, interpret complex situations, build relationships, and communicate effectively are likely to remain in demand. The role will likely evolve, requiring adaptability and a focus on value-added analysis that machines cannot easily replicate.

Concluding Thoughts

Embarking on a career as an equity analyst requires dedication, strong analytical capabilities, and a passion for understanding businesses and markets. It's a challenging field that demands continuous learning and adaptation, particularly with evolving technologies like AI and the increasing importance of factors like ESG. However, it offers intellectually stimulating work, the potential for significant impact on investment decisions, and diverse pathways for long-term career growth within the financial industry. Whether you are building your foundation through formal education, enhancing your skills via online platforms like OpenCourser, or pursuing professional certifications like the CFA, a focused and persistent approach can lead to a rewarding career analyzing the world of equities.