Good to know

Save this course

Reviews summary

Not beginner-friendly, outdated

Activities

Learn about stock valuation techniques

Show steps

Explore tutorials on stock valuation techniques to supplement your knowledge from the course.

Browse courses on

Stock Valuation

Show steps

-

Search for online tutorials or courses on stock valuation.

-

Follow the tutorials and practice the techniques.

-

Apply the techniques to real-world examples.

Rank stocks by company success

Show steps

Practice ranking stocks based on company success to reinforce your understanding of stock valuation.

Show steps

-

Collect data on company performance metrics, such as revenue, earnings, and growth rate.

-

Analyze the data to identify companies with strong financial performance.

-

Rank the companies based on your analysis.

Rank stocks by value

Show steps

Practice ranking stocks based on value to reinforce your understanding of stock valuation.

Show steps

-

Collect data on stock prices and financial ratios, such as P/E ratio and debt-to-equity ratio.

-

Analyze the data to identify stocks that are undervalued.

-

Rank the stocks based on your analysis.

Five other activities

Expand to see all activities and additional details

Show all eight activities

Discuss stock valuation strategies with peers

Show steps

Engage in discussions with peers to share and exchange knowledge about stock valuation strategies.

Browse courses on

Stock Valuation

Show steps

-

Join or create a study group or online forum.

-

Participate in discussions and share your insights.

-

Seek feedback and learn from others.

Attend a stock valuation workshop

Show steps

Attend a stock valuation workshop to gain insights from industry experts and network with professionals.

Browse courses on

Stock Valuation

Show steps

-

Search for stock valuation workshops in your area.

-

Register for a workshop.

-

Attend the workshop and participate actively.

Network with professionals in the stock valuation industry

Show steps

Network with professionals in the stock valuation industry to learn about career opportunities and gain valuable insights.

Browse courses on

Stock Valuation

Show steps

-

Attend industry events and conferences.

-

Join professional organizations.

-

Reach out to professionals on LinkedIn.

Develop a stock valuation model

Show steps

Create a stock valuation model to apply the concepts learned in the course to a practical scenario.

Browse courses on

Stock Valuation

Show steps

-

Choose a company to value.

-

Collect data on the company.

-

Build a financial model to value the company.

-

Write a report summarizing your findings.

Contribute to open-source stock valuation tools

Show steps

Contribute to open-source stock valuation tools to gain practical experience and deepen your understanding of the subject.

Browse courses on

Stock Valuation

Show steps

-

Identify open-source stock valuation tools.

-

Review the code and documentation.

-

Make contributions to the project.

Learn about stock valuation techniques

Show steps

Explore tutorials on stock valuation techniques to supplement your knowledge from the course.

Browse courses on

Stock Valuation

Show steps

- Search for online tutorials or courses on stock valuation.

- Follow the tutorials and practice the techniques.

- Apply the techniques to real-world examples.

Rank stocks by company success

Show steps

Practice ranking stocks based on company success to reinforce your understanding of stock valuation.

Show steps

- Collect data on company performance metrics, such as revenue, earnings, and growth rate.

- Analyze the data to identify companies with strong financial performance.

- Rank the companies based on your analysis.

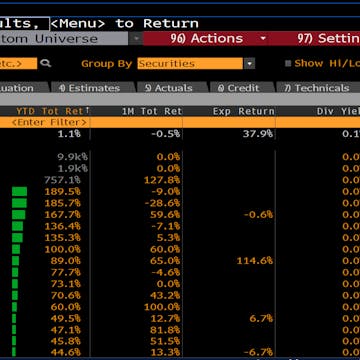

Rank stocks by value

Show steps

Practice ranking stocks based on value to reinforce your understanding of stock valuation.

Show steps

- Collect data on stock prices and financial ratios, such as P/E ratio and debt-to-equity ratio.

- Analyze the data to identify stocks that are undervalued.

- Rank the stocks based on your analysis.

Discuss stock valuation strategies with peers

Show steps

Engage in discussions with peers to share and exchange knowledge about stock valuation strategies.

Browse courses on

Stock Valuation

Show steps

- Join or create a study group or online forum.

- Participate in discussions and share your insights.

- Seek feedback and learn from others.

Attend a stock valuation workshop

Show steps

Attend a stock valuation workshop to gain insights from industry experts and network with professionals.

Browse courses on

Stock Valuation

Show steps

- Search for stock valuation workshops in your area.

- Register for a workshop.

- Attend the workshop and participate actively.

Network with professionals in the stock valuation industry

Show steps

Network with professionals in the stock valuation industry to learn about career opportunities and gain valuable insights.

Browse courses on

Stock Valuation

Show steps

- Attend industry events and conferences.

- Join professional organizations.

- Reach out to professionals on LinkedIn.

Develop a stock valuation model

Show steps

Create a stock valuation model to apply the concepts learned in the course to a practical scenario.

Browse courses on

Stock Valuation

Show steps

- Choose a company to value.

- Collect data on the company.

- Build a financial model to value the company.

- Write a report summarizing your findings.

Contribute to open-source stock valuation tools

Show steps

Contribute to open-source stock valuation tools to gain practical experience and deepen your understanding of the subject.

Browse courses on

Stock Valuation

Show steps

- Identify open-source stock valuation tools.

- Review the code and documentation.

- Make contributions to the project.

Career center

Stockbroker

Investment Analyst

Quantitative Analyst

Research Analyst

Hedge Fund Manager

Venture Capitalist

Financial Risk Manager

Private Equity Investor

Data Scientist

Corporate Finance Analyst

Financial Analyst

Actuary

Investment Banker

Portfolio Manager

Financial Planner

Reading list

Share

Similar courses

OpenCourser helps millions of learners each year. People visit us to learn workspace skills, ace their exams, and nurture their curiosity.

Our extensive catalog contains over 50,000 courses and twice as many books. Browse by search, by topic, or even by career interests. We'll match you to the right resources quickly.

Find this site helpful? Tell a friend about us.

We're supported by our community of learners. When you purchase or subscribe to courses and programs or purchase books, we may earn a commission from our partners.

Your purchases help us maintain our catalog and keep our servers humming without ads.

Thank you for supporting OpenCourser.